Data

Demographics

| Description | 2020 | 2025 Projection | 2010 Census | 2000 Census |

| Population | 24,409 | 25,000 | 23,497 | 21,908 |

| Households | 7,808 | 7,948 | 7,831 | 7,145 |

Family Households | 6,042 | 6, 182 | 6,238 | 5,944 |

Location

Watauga is in the Mid-Cities area of the DFW region and enjoys the benefits of excellent transportation infrastructure.

– Proximity to Interstate Highway: 3.2 miles, I-820

– Proximity to Major Highway: 0 miles, US 377

– Nearest Commercial Airport: 12.9 miles, DFW International

– Proximity to Regional Airport: 23.4 miles, Dallas Love Field

– Proximity to Public Airport: 11.6 miles, Fort Worth Alliance

– Nearest Rail Passenger Service:

Trinity Metro TEXRail, Iron Horse Station; Trinity Metro TEXRail, Smithfield Station; Amtrak Station, Fort Worth – 1001 Jones Street

– Nearest Barge Port: 205 miles, Shreveport, LA

– Nearest Deepwater Port: 311 miles, Texas City, Texas

– Proximity to Mexican Border: 960 miles

Workforce

- Watauga draws from a commuting range of 10-50 miles

- Workforce age population base (18)

| City | Labor Force | Percent |

Fort Worth, TX | 1,079 | 25.8% |

Dallas, TX | 226 | 5.4% |

| North Richland Hills, TX | 206 | 4.9% |

| Watauga, TX | 204 | 4.9% |

| Arlington, TX | 202 | 4.8% |

| Haltom City, TX | 164 | 3.9% |

| Keller, TX | 113 | 2.7% |

| Hurst, TX | 73 | 1.7% |

| Denton, TX | 72 | 1.7% |

| Euless, TX | 70 | 1.7% |

| All Other Locations | 1,771 | 42.4% |

Employment/Unemployment

| Age | Total Estimate | Labor Force Participation Rate Estimate | Employment/Population Rate Estimate | Unemployment Rate Estimate |

| Population 16 and over | 19,283 | 70.4% | 67.4% | 4.3% |

| 16 to 19 | 1,628 | 34.3% | 30.5% | 11.3% |

| 20 to 24 | 2,119 | 88.1% | 81.5% | 7.5% |

| 25 to 29 | 1,603 | 87.3% | 80.8% | 7.4% |

| 30 to 34 | 2,133 | 86.8% | 85.0% | 2.2% |

| 35 to 44 | 3,506 | 87.7% | 85.7% | 2.3% |

| 45 to 54 | 2,763 | 80.8% | 79.0% | 2.2% |

| 55 to 59 | 1,708 | 81.8% | 77.3% | 5.5% |

| 60 to 64 | 1,184 | 63.3% | 60.6% | 4.1% |

| 65 to 74 | 1,687 | 22.0% | 21.3% | 3.0% |

| 75 and over | 952 | 8.4% | 8.4% | 0.0% |

Employment Status American Community Survey

Source: United States Census Bureau

Major Employers

| # | Employer | # of Employees |

| 1 | Target | 245 |

| 2 | Birdvillle ISD | 195 |

| 3 | City of Watauga | 190 |

| 4 | Albertson’s | 176 |

| 5 | Harvest Baptist | 100 |

| 6 | North Pointe Health & Rehab | 92 |

| 7 | Fresco’s | 60 |

| 8 | Keller ISD | 110 |

| 9 | Cotton Patch Cafe | 54 |

| 10 | Chili’s | 52 |

Taxes

Texas has a long history of being a low tax, business-friendly state. It also has a wealth of natural resources, shares a border with Mexico, is one of the United States’ largest trading partners, and has a growing consumer base in a nation where consumers fuel 70 percent of economic growth.

Because Texas has a comparably low per-capita tax rate (no state income tax or statewide property tax), both Watauga and Tarrant County are quite attractive from a tax perspective.

Local Tax

Property Taxes – Texas has no statewide ad-valorem property tax. Local governments and special taxing districts levy property taxes on real and tangible personal property. All property is appraised at full-market value, and taxes are assessed by local county assessors on 100% of appraised value.

| Taxing Entity | 2020 Tax Rates |

| City of Watauga | .580404 |

| Tarrant County | .234 |

| Birdville ISD | 1.3804 |

| Keller ISD | 1.3947 |

| Tarrant County College | .13017 |

| Tarrant Country Hospital | .22429 |

| Total Property Tax Rate | 3.943864 |

Note: Tax Rate is for properties Sales Taxes – Maximum rate is 8.25% (exemptions for groceries, medicine, property for resale, manufacturing equipment, and many items used exclusively on farms and ranches for food production). the city limits of Watauga. The City of Watauga is served by two school districts.

Sales Taxes – Maximum rate is 8.25% (exemptions for groceries, medicine, property for resale, manufacturing equipment, and many items used exclusively on farms and ranches for food production).

| Taxing Jurisdiction | Tax Rate |

State of Texas | 6.25% |

Watauga Crime Control & Prevention District | .50% |

Watauga Economic Development Corporation | .25% |

City of Watauga | 1.25% |

Total Sales Tax Rate | 8.25% |

Note: Tax Rate is for properties within the city limits of Watauga

State Taxes

The State of Texas has an assortment of taxes that may or may not be applicable, depending on the type of business. Listing of the various statewide taxes and rates.

Income Taxes

- Texas does NOT have a Personal Income Tax

- Texas does NOT have a Business Income Tax

Corporate Franchise Tax

The Corporate Franchise Tax is imposed upon all corporations and limited liability companies that do business in Texas, or that are chartered or authorized to do business in the state.

Corporations pay the greater of the tax on net taxable capital or net taxable earned surplus. Taxable capital is a corporation’s stated capital (capital stock) plus surplus. Surplus means the net assets of a corporation minus its stated capital. For a limited liability company, surplus means the net assets of the company minus its members’ contributions. State of Texas FAQ list for more information on the Corporate Franchise Tax, include the tax rates

Incentives

- Tax Abatements

- Economic Development Grant (Chapter 380)

- Infrastructure

Financial Institutions:

Chase Bank

6624 Watauga Rd.

Watauga, TX 76148

817-788-7650

Wells Fargo Bank

7830 Denton Hwy

Watauga, TX 76148

EECU

7436 Denton Hwy

Watauga, TX 76148

817-882-0425

Southside Bank

8024 Denton Hwy

Watauga, TX 76148

Transportation

| Distance | Location |

| 8 miles | Downtown Fort Worth |

| 11 miles | DFW Airport |

| 30 miles | Downtown Dallas |

| 12 miles | Fort Worth Alliance Airport |

| 23 miles | Dallas Love Field Airport |

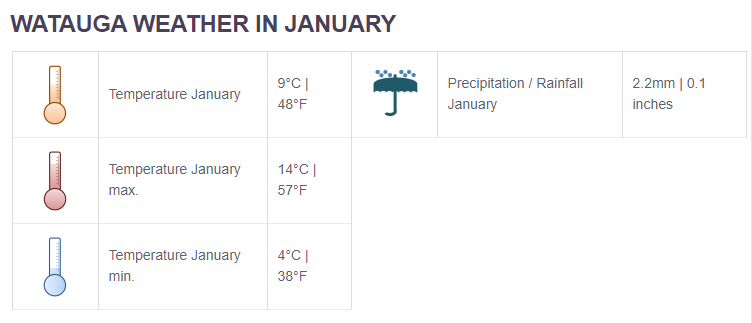

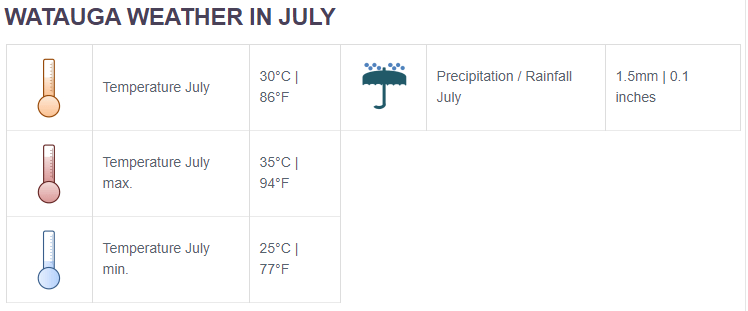

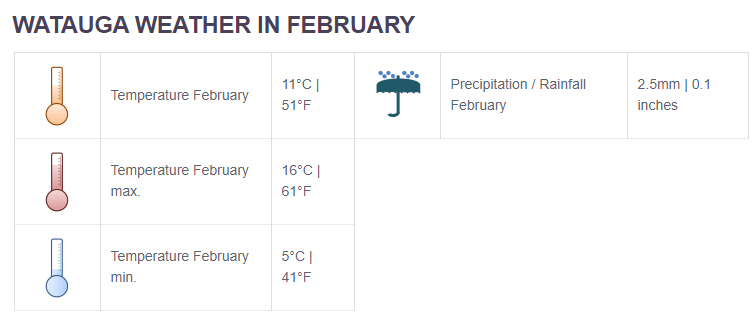

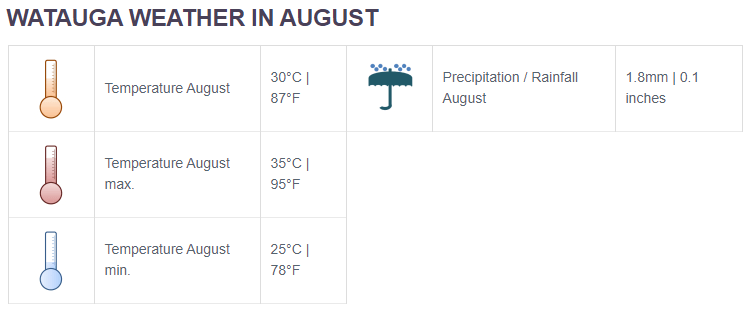

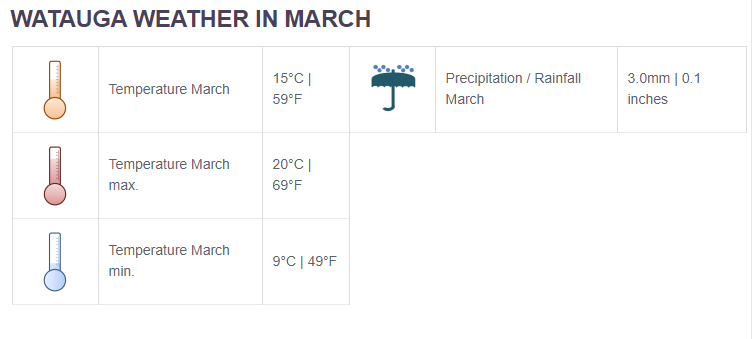

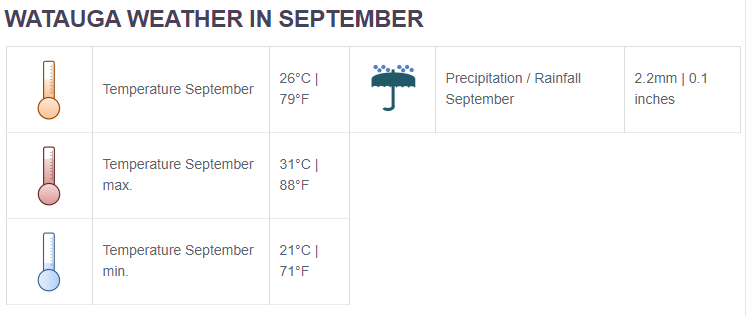

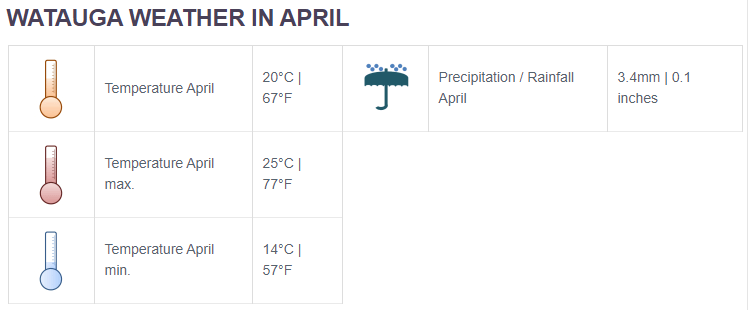

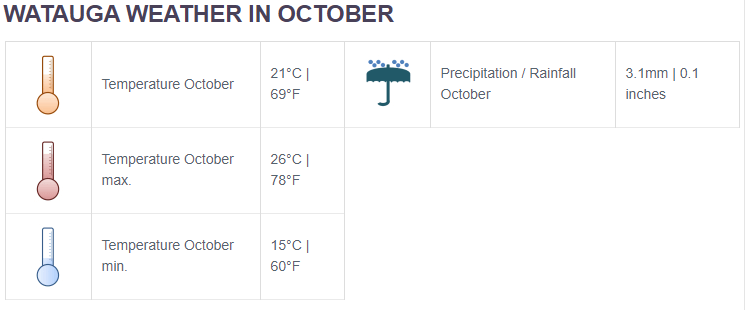

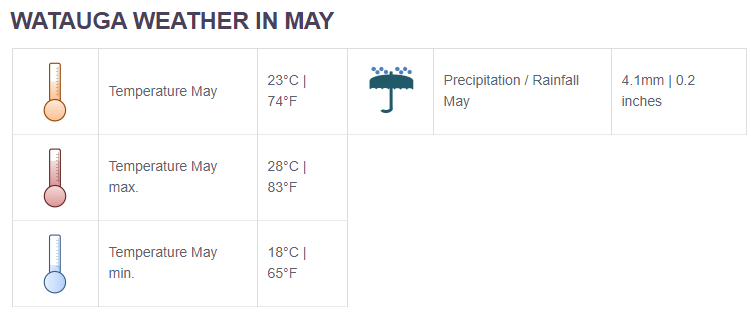

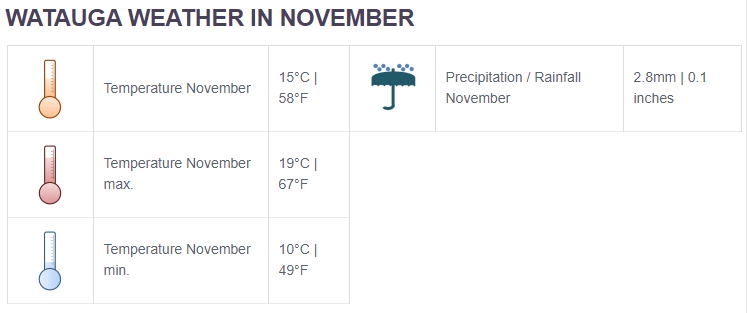

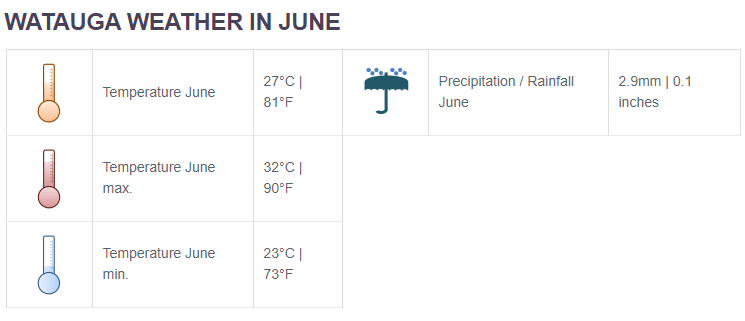

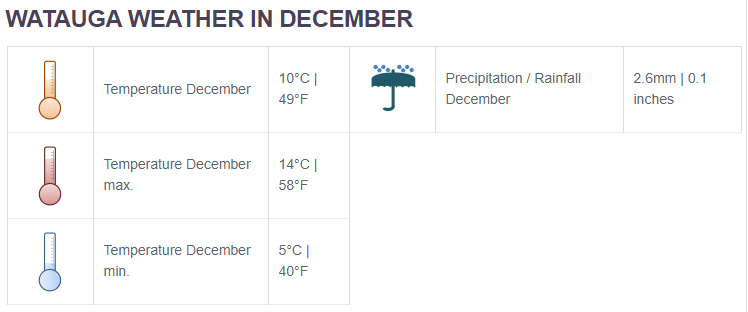

Climate

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sept | Oct | Nov | Dec | |

| Average HIGH | 55.9 | 66 | 73 | 69.1 | 88 | 82.9 | 93 | 91.9 | 96.1 | 81 | 72 | 57.9 |

| Average LOW | 39.9 | 32 | 55 | 46.9 | 59 | 70 | 77 | 68 | 70 | 59 | 45 | 27 |

| Average MEAN | 47.3 | 47.3 | 62.7 | 58.3 | 73.3 | 76.5 | 85.1 | 79.8 | 84.1 | 71.3 | 58.5 | 41.4 |

Average temperature in January 35 degrees

Average temperature in July 95 degrees

Average annual rainfall 38 inches

Days of sunny weather 233 days

Elevation above sea level 607 feet

Average growing season 264 days

Average first freeze November 14

Average last freeze March 21

All Temperatures are expressed in Degree Fahrenheit for CY 2020

Source: The Old Farmer’s Almanac